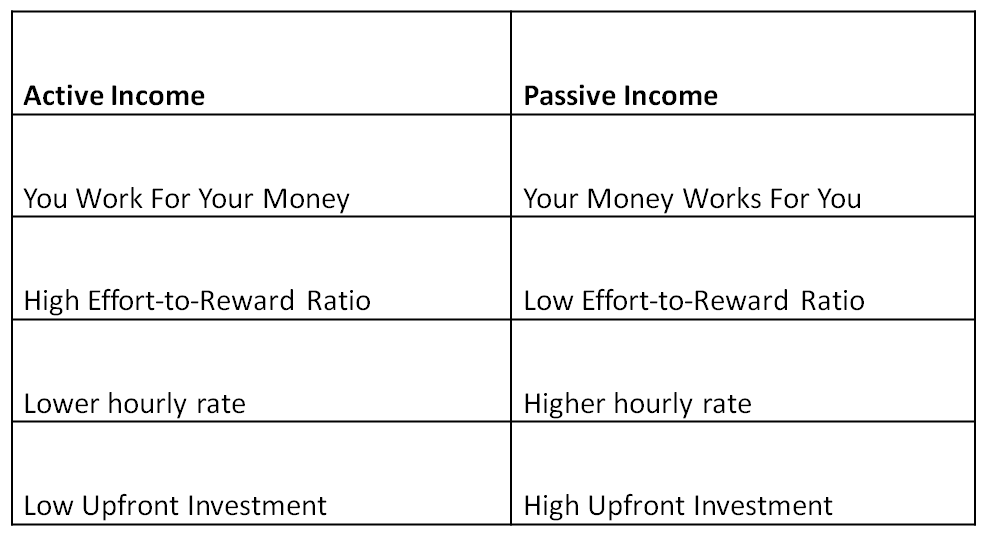

The work continues to generate income for you without continued effort on your part. Any proceeds you get from an investment where you have an interest in an asset are considered passive income. Passive income is earned from business initiatives where you invest capital and you aren’t directly involved in daily operations. active income, the types of businesses typically associated with each, and the level of involvement for investors or owners. "Unfortunately, it's next to impossible to find a true passive option," Hadary says.This article explains the difference between passive vs. Instagram accounts and blogs can lose popularity, for instance.And remember, most passive income streams require some serious exploration and work to set up. It takes a while to get to the point where you're like, 'Oh, wow, that's really a lot of money.'"ĭepending on the passive income mechanism, setting up an income stream can be daunting (or even temporary). "So even in an environment like now where the rents are generally going up - it takes a while to build up any compound return. "To live off your real estate, you're looking for positive cash flow," Meyer says. In some cases, yes, experts like Meyer say. Can you earn enough with passive income to make a living? Some investors hire management companies to take care of those details, making the investment more passive, Meyer notes. "Whether or not the tenant pays the rent, you still have to pay the mortgage, the property taxes and insurance and things like that," adds Meyer. That would be the caveat there."If you own property and are renting to tenants, for instance, there might be work up front to set everything up as well as regular maintenance. "It's passive in the sense that you're getting rents every month, but you still have to run your real estate like a business. Be sure to check the IRS website for details on passive income, like renting out property."Practically speaking, it's both passive and active," Meyer says. Unless you're in the real estate business as a profession, like real estate agents, the Internal Revenue Service (IRS) generally considers these kinds of investments passive income, Meyer says. Setup varies depending on the kind of income stream. How much up-front time will I need to invest to earn passive income? Other categories can "require some upfront money." You should always thoroughly research your idea before jumping in."Most people severely underestimate how difficult it is to consistently make money from books," says Hadary. Royalties from intellectual property like books, patents or music can also offer passive income. Activities like affiliate marketing or renting out your home take some initial setup and may require maintenance to produce a steady stream of cash. Yes, but be prepared to put in "sweat equity" - your time.

$100 month would take roughly $40,000, invested in a 3% dividend stock basket." Are there some types of passive income that require little money to start? "However, you need a lot of money to earn money. Lending money can be riskier than buying dividend-bearing stocks or a savings bond, experts note.Ī dividend, for example, "provides a decent return on investment and is very reliable, with zero effort," says Erin Hadary, a CFP with Denver-based Moneta Group Investment Advisors. You should also weigh risks against the likelihood of regular income. Others, such as affiliate marketing, take setup time and plenty of sweat equity. In some cases, such as buying stocks or property, you need upfront cash.

0 kommentar(er)

0 kommentar(er)